3% withholding tax triggered collapse in small-scale gold production — Sammy Gyamfi

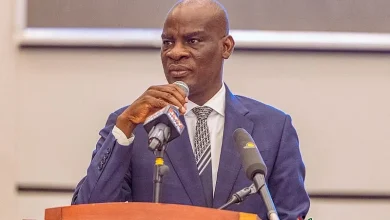

Chief Executive Officer of the Ghana Gold Board (GoldBod), Sammy Gyamfi, has revealed that the introduction of a 3% withholding tax in 2021 under the Akufo-Addo administration triggered a sharp decline in small-scale gold production and significantly reduced foreign exchange inflows.

Speaking on News File on Joy FM on Saturday, January 3, 2026, Mr Gyamfi disclosed that small-scale gold exports dropped steeply from 39.3 tonnes in 2020 to 3.4 tonnes in 2021 after the tax was implemented, costing Ghana billions of dollars in potential foreign exchange revenue.

“In 2021, the NPP introduced a 3% withholding tax on small-scale gold. Small-scale gold exports output declined sharply that year from 39.3 tons in 2020 worth 2 billion dollars to 3.4 tons. The whole year 2021 Ghana got 3.4 tons from small-scale sector because of 3% discount in the form of withholding tax. And FX inflows reduced from 2 billion dollars from 2020 to 185 million dollars.”

According to Sammy Gyamfi, the drastic reduction highlighted how highly sensitive the small-scale mining sector is to fiscal policy decisions, stressing the importance of safeguarding macroeconomic stability rather than focusing narrowly on accounting gains.

He noted that the 2021 experience has shaped the current strategy adopted by the Bank of Ghana and GoldBod, particularly in prioritising gold reserve accumulation and currency stability over short-term profit considerations.

“So learning from this experience, the Bank of Ghana does not pursue its own accounting profits. Because the Bank of Ghana is a banker of last resort, it’s a banker of government, it is mandated to achieve price stability and support government’s economic policy. They are there to build reserves to ensure that your currency is strong and when you achieve that the benefits you get render any accounting loss infinitesimal.”